2024 Roll Return Fact Sheet

Key Facts

- MPAC delivers an assessment roll annually to municipalities and the Province of Ontario to support the calculation of property and education taxes. These assessed values are used by municipalities to distribute taxes, not determine them.

- The assessed value of all properties in Ontario is approximately $3.2 trillion.

- In 2024, MPAC added more than $42.7 billion in new assessment from new construction and improvements to existing properties.

- In November, MPAC mailed more than 627,000 Property Assessment Notices to property owners across Ontario, reflecting changes in assessment in support of year-end activities, including the return of the assessment roll on December 10.

- Property assessments for the 2025 property tax year will continue to be based on January 1, 2016 assessed values.

New Assessment

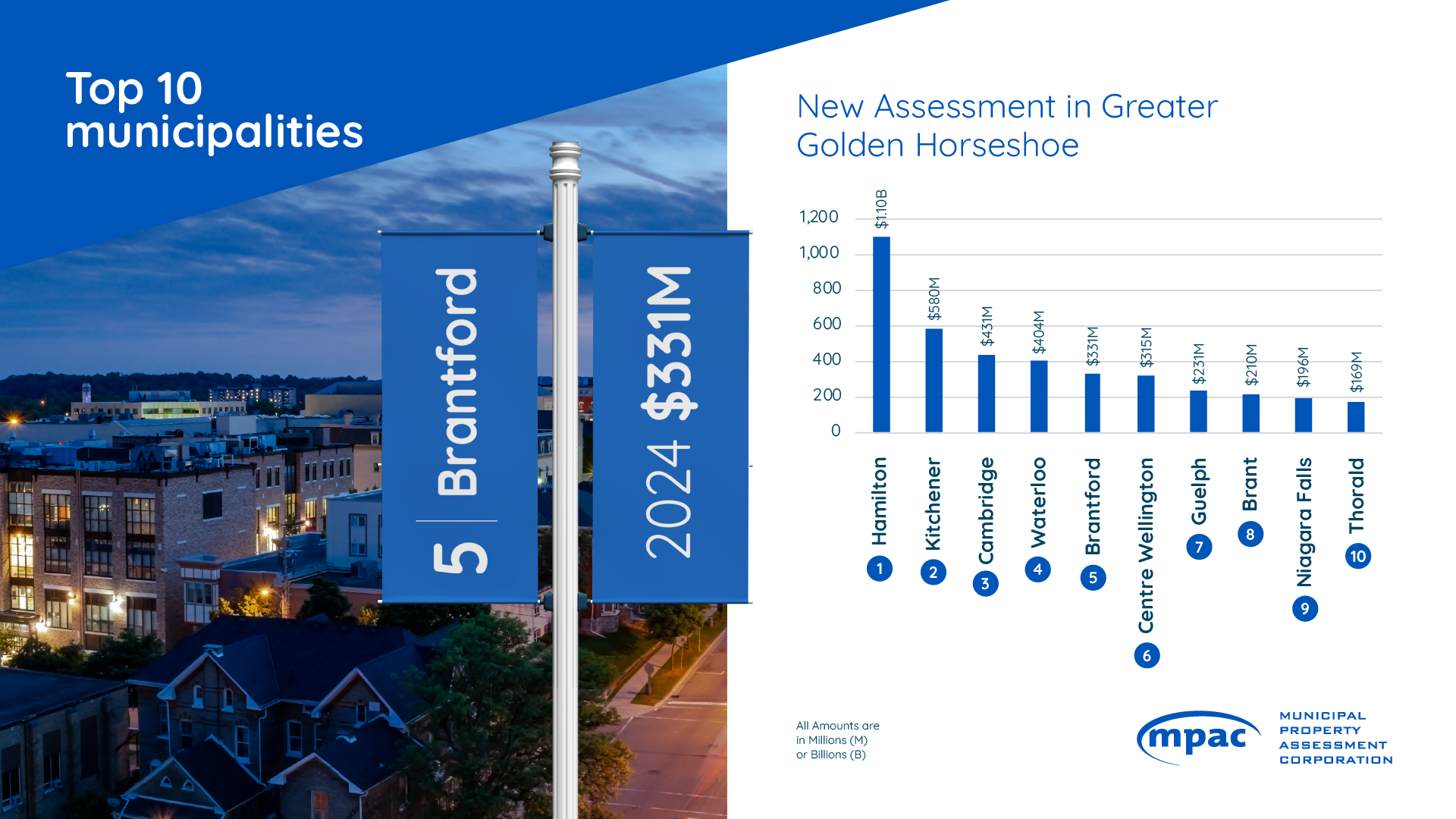

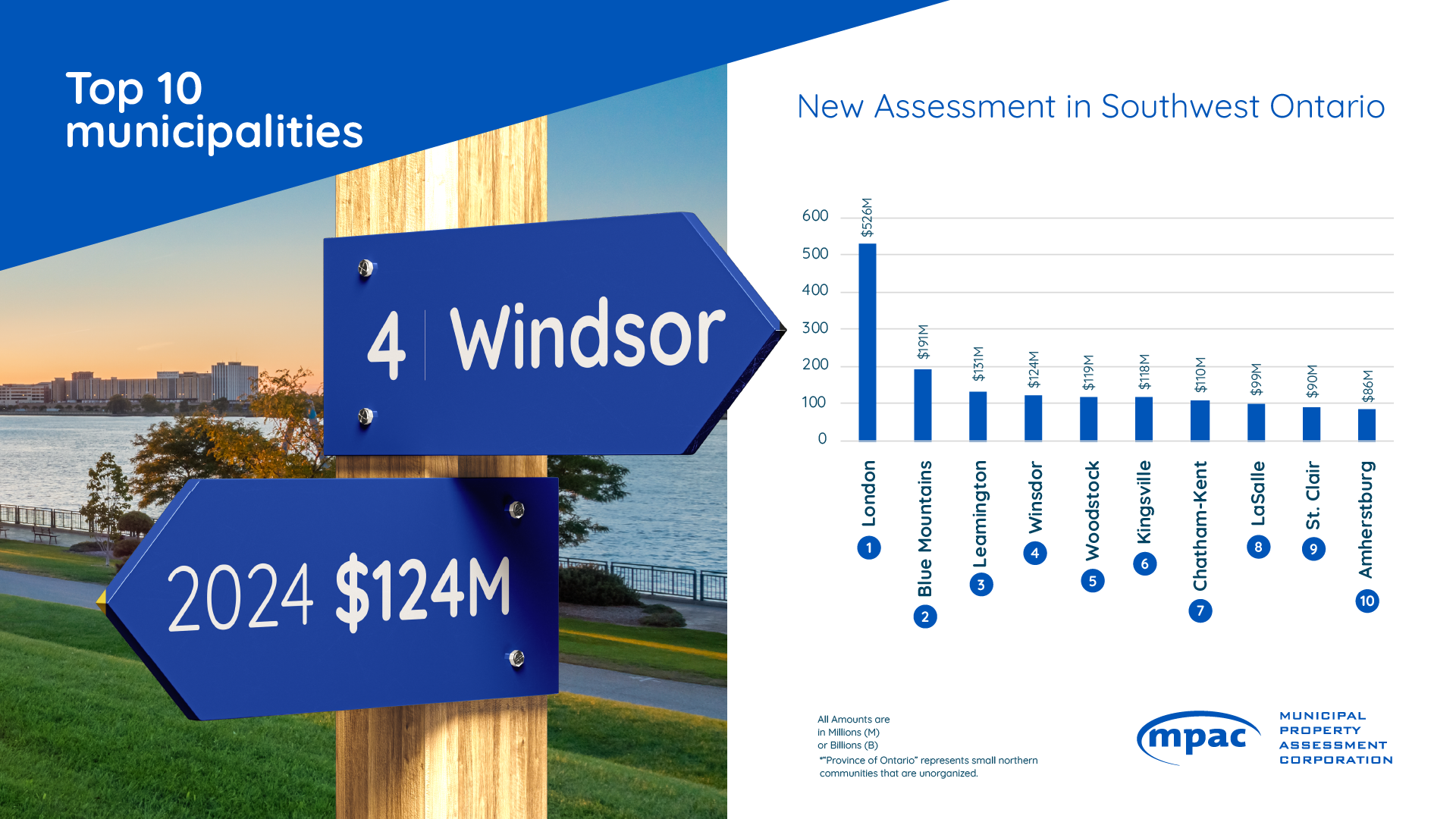

In 2024, MPAC captured more than $42.7 billion in new assessment. New assessment refers to new construction and/or additions to existing property that have been recently completed and assessed during the year.

New Assessment by Property Type

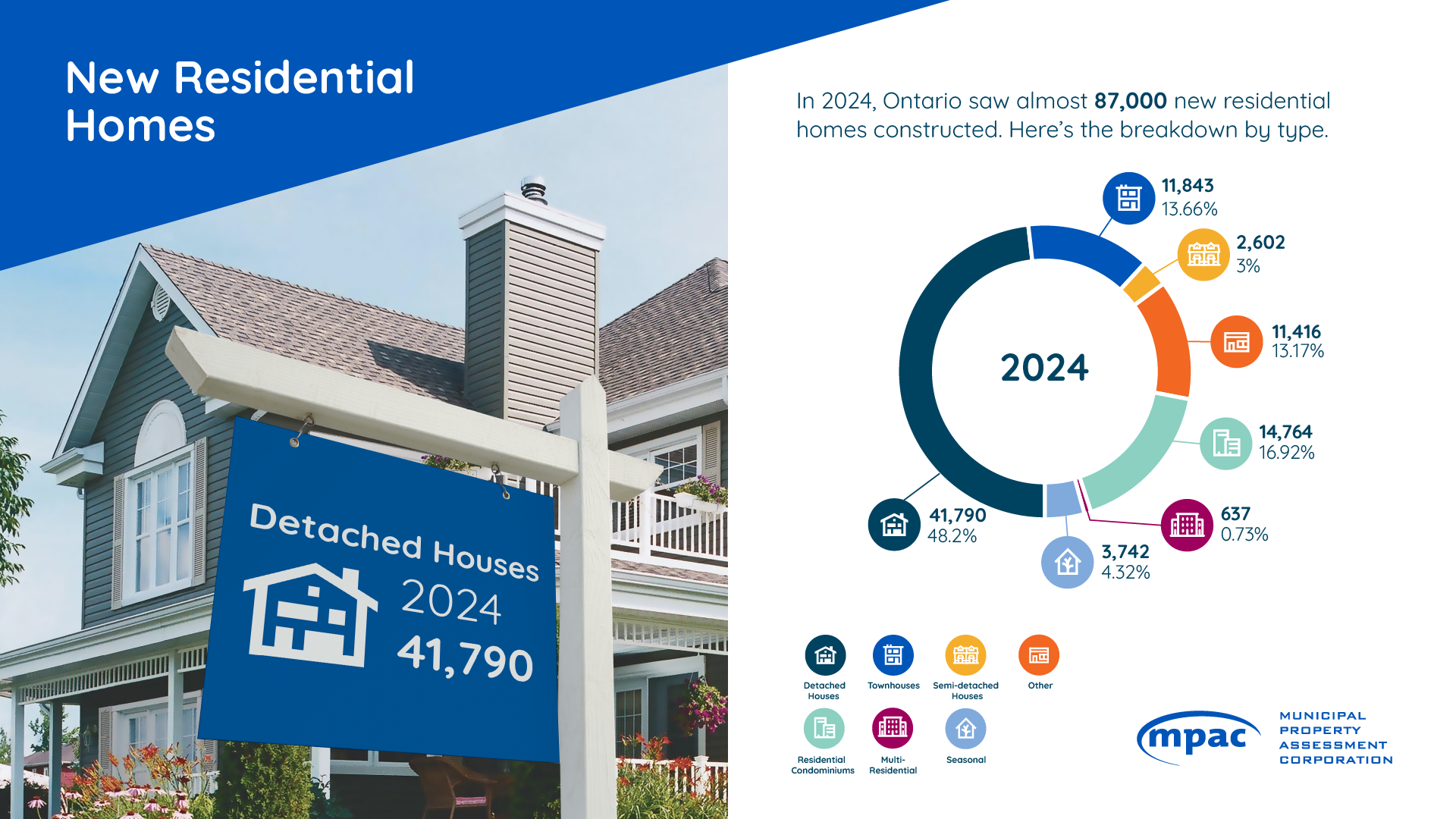

New Residential Homes

In 2024, Ontario saw more than 87,000 new residential homes constructed. Here’s the breakdown by type.